Accomplish Your Desires with the Assistance of Loan Service Experts

Accomplish Your Desires with the Assistance of Loan Service Experts

Blog Article

Pick From a Range of Finance Services for Personalized Financial Support

In today's complex economic landscape, people commonly discover themselves looking for tailored remedies to resolve their special financial demands. When it pertains to looking for financial support, the range of loan solutions readily available can be frustrating yet important in safeguarding individualized support. From financial obligation loan consolidation alternatives to customized finances dealing with particular requirements, the range of options supplied in the borrowing market can be both equipping and challenging. Financial Assistant. By exploring these diverse loan solutions, individuals can unlock opportunities for tailored monetary support that align with their objectives and conditions. The key depend on comprehending the details of each loan alternative and choosing the one that finest matches specific demands and choices.

Funding Choices for Financial Debt Loan Consolidation

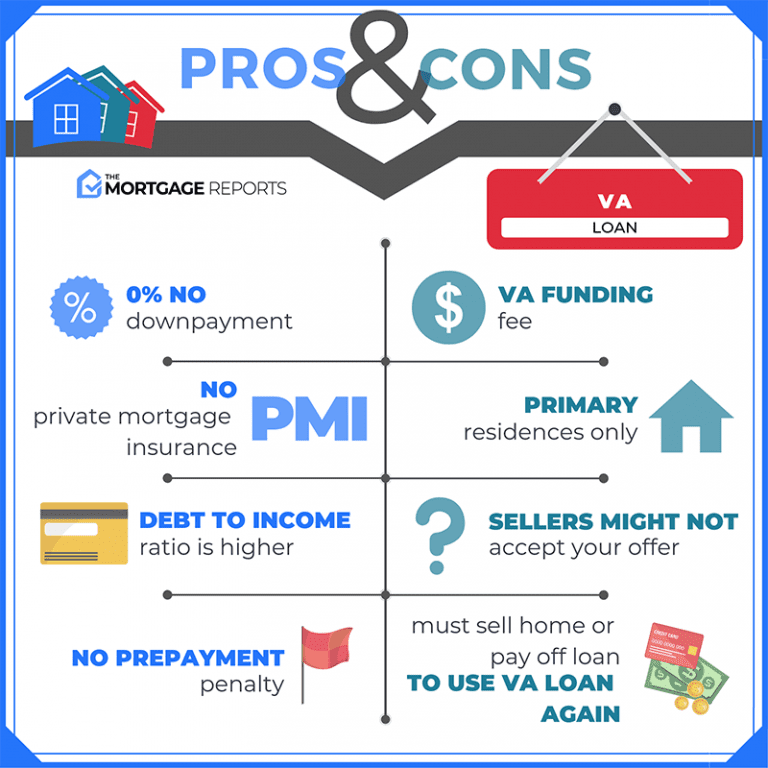

When considering lending choices for financial debt combination, people have numerous opportunities to discover (mca direct lenders). One typical alternative is a personal finance, which allows consumers to combine multiple debts into one financing with a dealt with month-to-month repayment and rate of interest rate.

An additional option is a home equity funding or a home equity line of credit history (HELOC), which makes use of the borrower's home as collateral. These loans usually have lower rates of interest contrasted to individual lendings however featured the danger of shedding the home if payments are not made. Equilibrium transfer bank card are also a prominent option for financial obligation combination, using an initial period with low or 0% rate of interest on moved equilibriums. It is important to very carefully consider the terms and fees linked with each choice prior to deciding on the most ideal lending for debt consolidation.

Individual Loans for Large Acquisitions

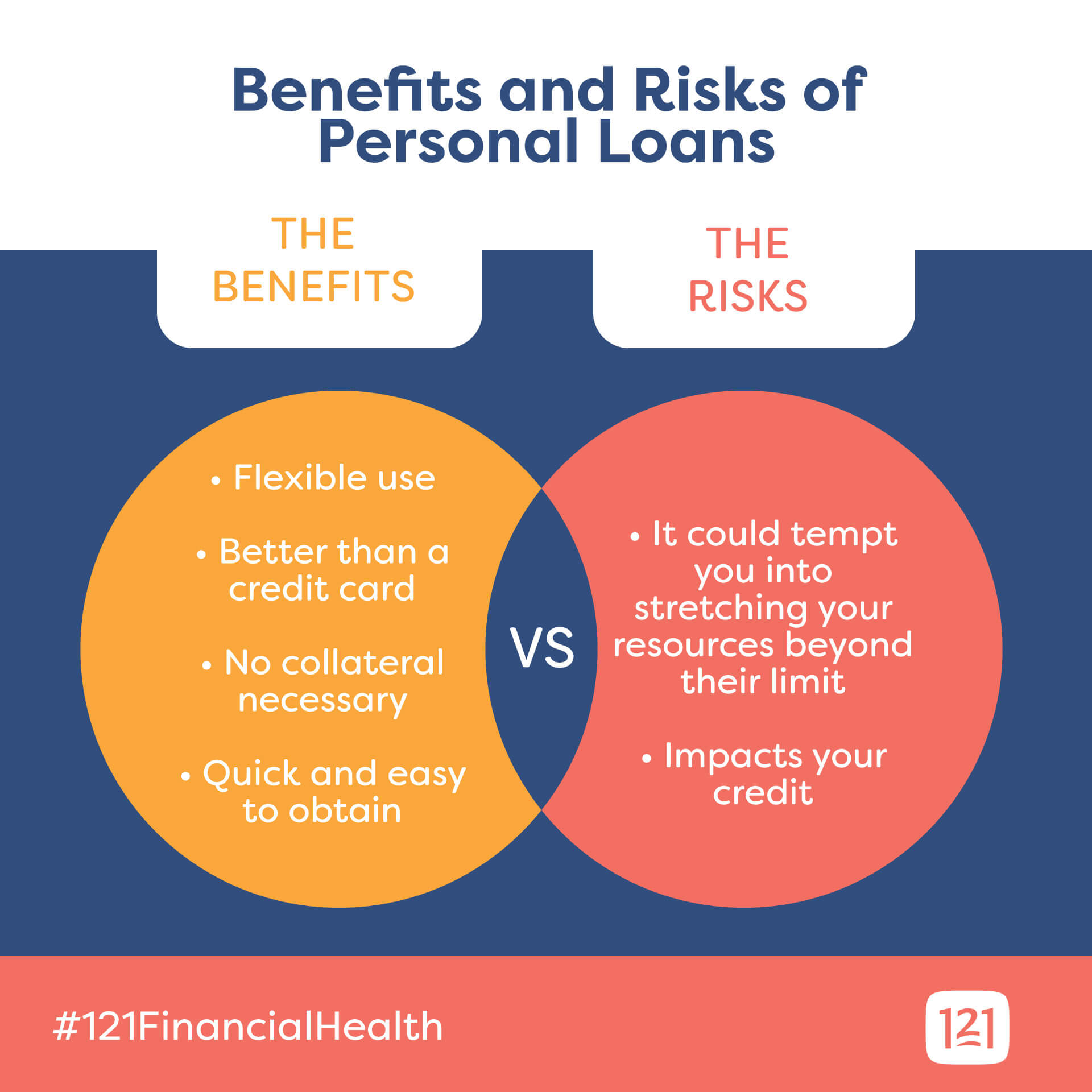

Advising on financial choices for substantial purchases commonly involves considering the option of making use of personal finances. Loan Service (same day merchant cash advance). When dealing with substantial expenses such as acquiring a new automobile, funding a home remodelling job, or covering unanticipated medical bills, personal loans can give the necessary financial backing. Personal fundings for large purchases use individuals the adaptability to obtain a specific amount of cash and repay it in taken care of installments over a fixed period, normally varying from one to 7 years

One of the vital benefits of individual finances for considerable procurements is the capacity to access a lump sum of cash upfront, permitting individuals to make the desired purchase immediately. Additionally, personal financings usually include competitive rates of interest based upon the debtor's credit reliability, making them an economical financing alternative for those with great credit score ratings. Before choosing an individual car loan for a big acquisition, it is vital to analyze the terms provided by different lending institutions to protect one of the most favorable deal that aligns with your economic goals and payment capacities.

Reserve and Payday Loans

When encountering an economic emergency situation, individuals ought to explore different options such as working out settlement plans with lenders, looking for assistance from regional charities or government programs, or borrowing from loved ones before turning to payday financings. Constructing an emergency fund over time can additionally assist mitigate the requirement for high-cost loaning in the future.

Specialized Lendings for Certain Needs

When looking for financial aid tailored to distinct conditions, individuals might discover specific funding options designed to address certain needs efficiently (Loan Service). Trainee car loans provide certain terms and advantages for instructional objectives, aiding trainees finance their research studies and relevant costs without frustrating financial worry.

Moreover, home improvement car loans are developed for property owners seeking to upgrade their article residential properties, providing practical repayment plans and affordable rate of interest for remodeling tasks. Furthermore, bank loan satisfy entrepreneurs seeking funding to start or expand their ventures, with specialized terms that align with the special requirements of organization operations. By checking out these specialized financing alternatives, individuals can discover tailored economic solutions that fulfill their details requirements, supplying them with the needed assistance to achieve their objectives effectively.

Online Lenders for Quick Approval

For expedited loan approval procedures, individuals can turn to on-line loan providers who offer swift and practical monetary services. On the internet lending institutions have actually revolutionized the borrowing experience by streamlining the application procedure and providing fast authorizations, occasionally within minutes. These lending institutions typically offer a wide variety of loan alternatives, including individual fundings, payday advance loan, installment lendings, and lines of credit history, accommodating diverse monetary needs.

One of the crucial benefits of on the internet lending institutions is the rate at which they can process funding applications. By leveraging innovation, these loan providers can examine a person's credit reliability quickly and make funding decisions swiftly. This effectiveness is particularly advantageous for those who require immediate access to funds for emergencies or time-sensitive expenditures.

Moreover, on the internet lending institutions typically have less rigid qualification standards contrasted to typical monetary institutions, making it less complicated for people with varying credit accounts to secure a financing. This access, integrated with the quick authorization process, makes on-line lending institutions a popular selection for numerous looking for quickly and problem-free monetary aid.

Conclusion

To conclude, individuals have a variety of car loan options offered to address their financial requirements. From financial debt combination to emergency funds and specific car loans, there are solutions customized to certain circumstances. On-line lenders additionally use fast approval for those looking for instant monetary support. It is essential for people to very carefully consider their choices and pick the finance service that finest fits their needs.

Report this page